PTU in Mexico is the statutory requirement for locally-based companies to share a portion of their profits with their employees, and something that investors must take into account when planning a market entry.

If you are interested in starting a business in Mexico, or are already doing business there, you will need to understand how employee profit sharing works in the country in order to avoid any type of financial penalty or legal inconvenience for non-compliance.

Officially called Employee Participation in Company Profits, PTU is the abbreviation of that phrase in Spanish (Participación de los Trabajadores en las Utilidades de la Empresa). PTU payments cannot be considered as part of an employee’s salary.

Note that following a period of loss followed by periods of profit, employees will not be eligible for compensation after non-payment of PTU during the loss period.

Some of the finer details of employee profit sharing in Mexico that will be covered in this article include:

- Which companies must undertake profit sharing in Mexico

- Which companies are exempt from PTU in Mexico

- Which employees are entitled to a share of profits

- How profit sharing in Mexico is calculated

- When PTU in Mexico is paid

If you would like to discuss how we can help you deal with profit sharing in Mexico, as well as a wide range of other back-office concerns, go ahead and contact us now.

Table of Contents

Which companies must undertake profit sharing in Mexico?

- Which companies are exempt from PTU in Mexico?

- Which employees are entitled to a share of profits?

- How is profit sharing in Mexico calculated?

- When is PTU in Mexico paid?

- Biz Latin Hub can assist you with PTU in Mexico

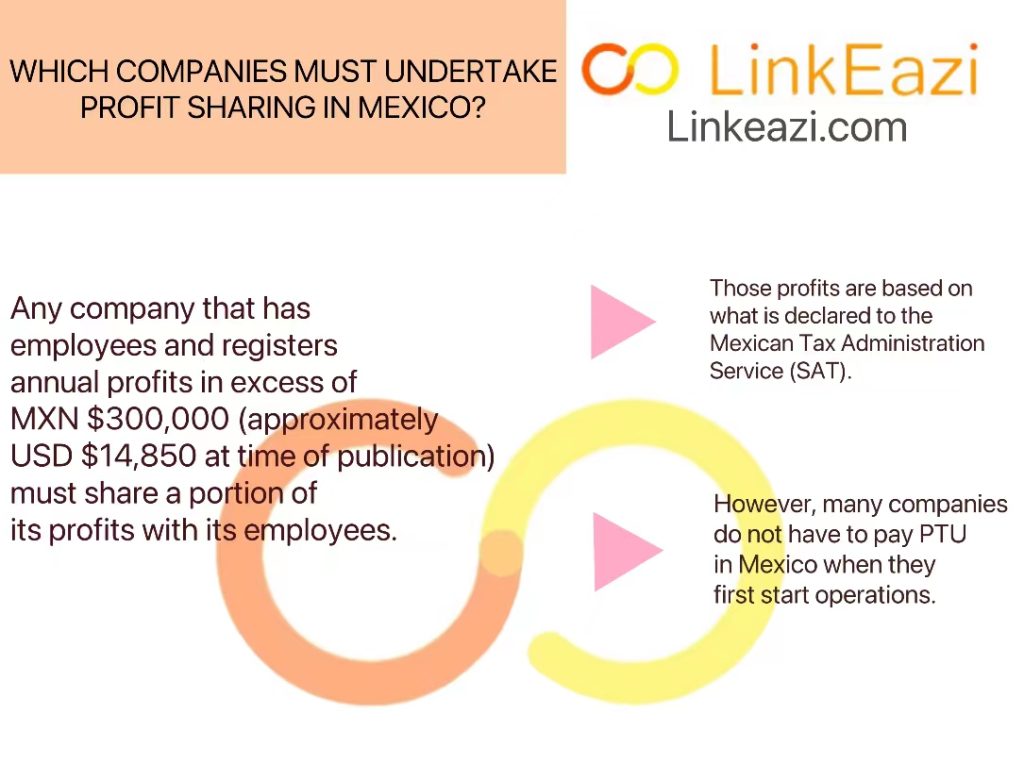

Which companies must undertake profit sharing in Mexico?

Foreign direct investment in the manufacturing sector in Mexico.

Any company that has employees and registers annual profits in excess of MXN $300,000 (approximately USD $14,850 at time of publication) must share a portion of its profits with its employees.

Those profits are based on what is declared to the Mexican Tax Administration Service (SAT).

However, as highlighted below, many companies do not have to pay PTU in Mexico when they first start operations.

Which companies are exempt from PTU in Mexico?

According to Article 126 of Mexico’s Federal Lab

or Law, any company in the first year of operations is exempt from paying PTU in Mexico, while entities whose main objective is the creation of a new product enjoy exemption during their first two years.

Further exemptions apply to the following entities:

- New companies focused on mining that are in their exploration period

- Private institutions that perform humanitarian and non-profitable activities

- Non-centralized institutions with cultural or social assistance purposes

- Organizations generating social capital, as established in an index established by Mexico’s Ministry of Labor and Social Welfare.

Which employees are entitled to a share of profits?

Most employees providing remunerated services to an employer are eligible for a share of profits, including:

- Permanent workers and subcontractors

- Temporary workers whose period of labor exceeds 60 days in a financial year

- Former employees who worked for at least 60 days during the financial year for which PTU is being paid

Note that a period of non-work due to statutory maternity leave does not affect an employee’s eligibility for receiving PTU in Mexico.

The following employees are not eligible for PTU payments:

- Directors, administrators, and senior executives

- Shareholders and stock owners

- Temporary workers who have worked less than 60 days of a given financial year

- Professionals hired under a services contract

- Domestic workers

For non-unionised workers, it is important to note that they are only eligible for PTU in Mexico if their salary does not exceed the highest salary of a unionized worker within the company. Meanwhile, employees whose main responsibilities involve caring for profit generating goods or real estate may only receive PTU when it does not exceed one month’s salary.

How is profit sharing in Mexico calculated?

Currently, a company must share 10% of the profits generated during a given financial year with its employees, as established by the National Commission for the Participation of Workers in the Profits of Companies.

When calculating PTU in Mexico, a company must first split those profits into two equal parts. The first part of profits will be divided evenly between all employees, based on how many days of the financial year they have worked.

The second part is distributed based on the salary an employee earns, with benefits and bonuses excluded.

When is PTU in Mexico paid?

Under Article 122 of the Federal Labor Law, PTU in Mexico must be paid no later than 60 days after the company is due to pay its annual tax contribution.

That is to say, if a company’s tax payment deadline is set for March 31, it is obliged to make profit sharing payments sometime between April 1 and May 31 of that same year.

Where employees are hired by an individual, not a company, the period during which PTU must be paid would be from May 1 to June 30, owing to the fact that individual taxes must be paid by April 31.

Biz Latin Hub can assist you with PTU in Mexico

At Biz Latin Hub, we have the personnel in place and expertise to help you manage PTU in Mexico. With our comprehensive portfolio of back-office solutions, including accounting & taxation, company formation, legal services, recruitment, and visa processing, we can be your single point of contact for launching and doing business in Mexico, or any of the other 17 markets in Latin America and the Caribbean where we have teams in place.

Contact us today for a free quote or consultation.

Or read about us.

The information provided here within should not be construed as formal guidance or advice. Please consult a professional for your specific situation. Information provided is for informative purposes only and may not capture all pertinent laws, standards, and best practices. The regulatory landscape is continually evolving; information mentioned may be outdated and/or could undergo changes. The interpretations presented are not official. Some sections are based on the interpretations or views of relevant authorities, but we cannot ensure that these perspectives will be supported in all professional settings.